Steve Keen is an excellent, left-field economist, and more importantly, is a fellow Australian. He hosts a fascinating and prolific blog called “Debtwatch”, that reports monthly on the dangers of excessive, private debt.

His primary message is that the “Efficient Markets Hypothesis”, which has dominated academic thinking about finance, even after the Global Financial Crisis, is fundamentally flawed. This hypothesis essentially states that all information is always built into markets. Hence, they operate perfectly in line with how Neoclassical Theory would expect them to operate (i.e. with supply and demand in perfect equilibrium and prices reflecting this perfectly).

Neoclassical Economics assumptions (John Keynes)?

1. People are rational 2. The market tends to equilibrium 3. Individuals have full information (“Efficient Markets Hypothesis”) 4. Individuals and firms maximize profit (“utility”) N.B. is taught in the majority of classrooms around the worldAustrian School assumptions (Friedrich Hayek)?

1. People are irrational 2. The market only tends toward a constantly changing equilibrium 3. Individuals lack full informationTo keep the economy going, the models would differ by:

Neoclassical would fight unemployment with inflation (government spending is needed to bolster aggregate demand in times of unemployment) Austrian would fight inflation with unemployment (no government spending, it’s arbitrary and intrinsically votes motivated)

However, Steve Keen’s main research focus has been the development of an alternative, empirically grounded theory, known as the “Financial Instability Hypothesis”. Echoing somewhat the Austrian school of thought, he argues that financial markets are inherently unstable. Well, that’s perhaps not a particularly big stretch of the imagination? Nevertheless, many economists, including those who work with me, frequently cite models that pivot on the premise that markets tend to a perfect equilibrium – it makes the Math easier for one. However, surely commonsense would tell us that no complex system ever obtains equilibrium. All systems are constantly influenced by external stimuli and thus the playing field is always moving and evolving; hence creating new equilibria. Consequently, I wholeheartedly agree with Steve Keen’s scepticism about the “Efficient Markets Hypothesis”.

In addition, the “Efficient Markets Hypothesis” implies that people operating within a market generally act in line with the expectations of Neoclassical Theory, namely Rationally. However, many economists have disputed the this concept. Behavioural economists attribute the imperfections in financial markets to a combination of cognitive biases such as overconfidence, overreaction, information bias, human errors in reasoning, and let’s not forget, irrational, emotional responses. Humans are fallible, markets can surely never really be perfectly efficient and rational in their decision-making?

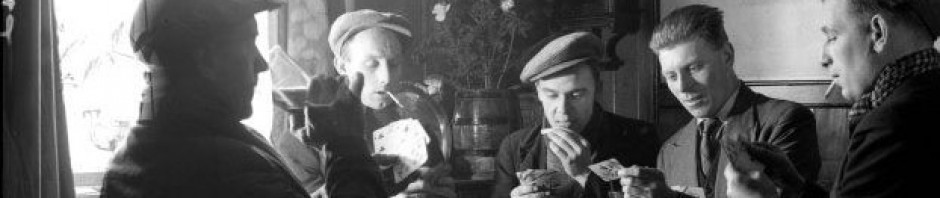

Thus, yes, I do agree with Steve Keen’s sentiments about the tenuousness of rational economic models, but I don’t necessarily follow his view all the way. A few days ago, a heated discussion about his blog occurred among some friends and one of them, Les Richardson, summed up the prevailing opinion quite eloquently. So, here’s a guest-post by Les commentating on Steve Keen’s economic philosophy:

Click here for the original post by Steve Keen.

Commentary by Les Richardson on Steve Keen:

Here’s my take on Steve Keen’s views of global economics as stated in his blog “The Debtwatch Manifesto“.

To be fair, I think he misses the point entirely. Well, there you have it… in a nutshell.

Right, for a start he’s a modern Keynesian. Keynes was about using the government to stimulate the economy, but that doesn’t mean he believed governments should just throw money out of the window, squandering it. Modern Keynesians no longer understand the differences between successful investment, unsuccessful investment, and just plain excessive spending.

The GFC was a bubble bust. Bubbles can occur for a variety of reasons, but usually it arises from a distortion in the market – and nothing creates distortions like government intervention and regulation.

The property bust in the U.S. (if the cause of the GFC), and the property bust in China, which will probably hit big time in 2012 or 2013, are interesting bubbles to examine because they are both the unforeseen results of government policy, but for quite different reasons.

In the U.S., the housing bubble was a direct consequence of deliberate policy to make housing more affordable, but through a Fascist approach (i.e. government coercion of the private sector) rather than Socialistic (i.e. government providing the housing itself). Banks were legislated to give high risk loans, essentially as a cost of doing business in a particular area. As a tax, that can be done (and the effects are like any other tax), but in the U.S., they took it a lot further. Business will go wherever it can – the government wanted people to get housing, and the banks to fund it, so the oft-described “greed” aspect was really just delivering government policy at a profit. Sensible credit considerations did not apply, as the banks were required to do it anyway (there are parallels here to the building of blatantly, non-viable, wind farms). Government, guaranteed entities (Freddie Mac and Fannie Mae) were underwriting these mortgages, and in any case, as long as property prices continued rising, repossessed properties could be sold and all outstandings recovered. Buyers/Investors also had minimal risk, provided they used mostly borrowed money, as they could return the keys at any time and effectively end the mortgage at any time, leaving the bank to cover any shortfall (here in Australia, if the property cannot be sold to cover the entire mortgage, the mortgagee must make up the shortfall).

Put together a “no risk” position for investors, and a “no risk” position for the lender, insurers, enablers etc, and you have a bubble forming. Because the whole set-up was underpinned by rising house values (this was how everyone could liquidate their positions) it lasted for as long as the house prices went up. When they waivered in 2007-2008, the entire system collapsed very quickly.

The contribution of CDO’s (Collateralized debt obligations), and ratings agency’s, and AAA-rated, credit wrapping – the whole Wall Street phenomenon – served to make it a bigger bubble than it might otherwise have been. This is because everyone got in on the act to trade in the “extra” market created by the simple fact that so many houses were being built to be sold to people who could not afford them on sub-prime loans. Sub-prime loans grew in volume over decades, so it was actually part of the business landscape, but changes in the law from the initial Carter era laws, beefed up under Clinton, and run riot with under the last 6 years of Bush once the Democrats got control of Congress, escalated the growth. Freddie Mac and Fannie Mae blatantly lied about their exposures to sub-prime loans to Congress (they have recently pleaded guilty to the SEC for this), and Barney Frank, as Chairman of the overseeing House Committee, blocked all attempts to investigate.

The markets can be criticised for acting stupidly in attempting to implement government policy, but, like electricity retailers mandated to source “renewable” energy, to a large degree they had little choice.

This policy of coercing banks to lend massively to customers who could never afford to pay the loans back, was doomed in the long term, and the crash was inevitable. Like any crash, the longer it took to occur, the bigger the bubble, the worse it became. Government intervention, and a system which protected investors from losses, underscored by 25 years of rising house prices, put off the day of reckoning, but it was inevitable in the end.

The corporate profit motive was a component in the process, true, but only to the extent that it encouraged active participation by the private sector. It was not the cause of the problem (and if it had been, the bubble would have burst a lot earlier because of the lack of artificial, warping factors). The banks were just a catalyst to flawed, governmental policy.

In China, the story is a bit different. The government there has made it very difficult for individual investors to invest their money profitably. Interest rates on deposits are regulated and too low – lower than inflation. One of the few avenues open to the small scale investor is the property market – and with a billion people, that’s also what the government wants. But, by only allowing that one basic investment avenue, the government has created a market distortion, and artificial incentive which has guaranteed property development has moved ahead of demand – ergo a bubble has formed. It is a completely different type of distortion to the U.S. government’s, but the effect will nonetheless be similar. It hasn’t been going on as long, but the scale of China is so big that the effect will be a strong one.

Steve Keen talks about Neoclassical economics – basically (his namesake) Keynes – and clearly has no time for it. Like a lot of left-leaning economists or commentators, he misunderstands Keynes as badly as he does, his great rival of the day, Hayek.

Whilst Keynes is about what the benefits that government can do, Hayek is about the damage they can do – which viewpoint is correct really depends on the outcome. Keynes is used as an excuse for unbridled government control and expenditure, and governments generally have a poor record at getting it right. Hayek’s basic premise is that the government sucks resources from the private sector, and lacks economic corrective mechanisms (i.e. when the private sector gets it wrong, it goes bust – whereas when the government squanders money it just increases taxes and suck more resources from the economy).

Steve Keen talks about private debt being the problem, but that’s misplaced. It is to a large degree the symptom not the cause. He doesn’t look at the root causes, I believe. Private borrowing, particularly in respect of the property market in the U.S., flourished because people thought it was risk free. They could just return the keys to wipe the obligation, but of course it is never that simple. Many bankrupted themselves first, trying to avoid giving up the property(s), because they were living beyond their means. Here the irresponsibility – and Moral Hazard – clearly lay with the lenders rather than the borrowers.

This is a very important point – Keen absolves investors of blame. And many would agree with him.

What he is really saying is people lack the ability to be responsible for their own actions (every sub-prime loan had an real-live applicant at the other end ). They really need the government to manage things for them – and we can see how that turns out. Give a person a handout and he’ll take it without much consideration. Even if instead of giving him a fish to eat, you could have given the fishing rod and would have quickly figured out how touse it and be self-sufficient. Try to think of any prosperous countries where the government controls the economy so voraciously? Ones like China have only started to find prosperity by freeing their economies up.

Central planning had its “fair go” in the Soviet block and it limped slowly and inevitably to economic collapse. A vibrant economy needs a government to empower its citizens and encourage them, not treat them all like the lowest common denominator and give them unsustainable handouts from the diminishing few who are actaully productive.

I reckon anyone who has the capacity to understand Steve Keen’s article should consider the data along with the suggested options to address issues presented.

Beware, there is quite a bit in here to digest.

Lol Keen-sian economics! Ha. Interesting read …. I’m sceptical but it is an excellent blog sensationalising the crisis a bit to perhaps support selling a book or two?!

Some links debunking the debunker..erer…somewhat.

To what extent can you believe Keen’s data?

2011

http://christopherjoye.blogspot.com/2011/08/steve-keen-wrong-on-house-prices-again.html

2009

http://www.news.com.au/business/economist-steve-keen-loses-housing-bet-against-rory-robertson/story-e6frfmbi-1225793985120

2008

http://www.crikey.com.au/2008/10/22/gerard-henderson-steve-keen-is-no-psychic/

To answer that it requires some time spent reading his blog. If you are sceptical then treat it as a healthy contrarian view to reinforce your own beliefs.

I like the fact that he references his data sources regularly being an academic. The comments section, although busy with fanboys, also have some interesting posts and references.

I read mainstream media also to balance the viewpoint. It’s important to listen to the debate or risk getting blinkered by what you have already settled on as the truth.

If you only read a MSM publication, you may only get a single biased view.

The book sales is a red herring, he is certainly not intending to get rich on the book. They are usually loss leaders to legitimise an opinion. It’s been years since he published it and the revision has just come out after a hell of a lot of blogging in between.

Time will tell if he is right. Maybe up to a decade.

How to silence a Nobel Prize winning economist: Ask him about the economy. You have to take all this modelling malarkey with a pinch of salt. Heck, I’m a financial modeller, Trust Me.

By his lordship, Peter Schiff:

http://www.youtube.com/watch?v=mFdnA5UNmVw&feature=feedu

What is capitalism? What is Greed? And why is an entrepreneur worth $50 mil (fill in the Mighty Michael Moore) telling us capitalism is bad?

And “Greed is Good” folks, it maximises the judicious use of risk-return analysis on investment…

This is so right:

http://www.youtube.com/watch?v=wXWoU0YqsU0&NR=1&feature=endscreen

Steve Keen, I like him, but he can be a deluded socialist (err a Michael Moore style champagne socialist) at times as well.

From Keen’s article:

“Most of this debt should never have been created, since all it did was fund disguised Ponzi Schemes that inflated asset values without adding to society’s productivity.”

“There are many other proposals for reforming finance, most of which focus on changing the nature of the monetary system itself. The best of these focus on instituting a system that removes the capacity of the banking system to create money via “Full Reserve Banking”… remove the capacity of the banking sector to create money, along the lines the 100% reserve proposals first championed by Irving Fisher during the Great Depression (Fisher 1936), and vest the capacity for money creation in the government alone.”

Aaaahhhhhhhhhh, the government will not only decide how to spend most of the economies wealth, but is in control of its production as well.

Lol – communism, what a success story that was.

The GFC was not because of greedy NYC bankers, it was the cronyism higher up: the private bank owners with their Democrat (the Republicans repeatedly try to reign in the housing bubble), congressman regulators that allowed 1% capital reserves at Fannie Mae. These plutocrats then fully bail out their risk-taking idiot underlings, like General Motors, when they should pay for their mistakes and lack of competitiveness – that’s real capitalism, accountability.

I had never heard of Keen before having him pointed out this week, and I wasn’t missing much, sadly.

He does a fascinating analysis of about one third of the issue, and ignores the rest. He is too idealistic and has some serious blinkers.

Interesting point about the Chinese property bubble. According to the Australian ambassador to China who I heard on the radio the other day (I must have been on holidays), there’s nothing to worry about because the Chinese only use cash to fund property investment as a form of proxy bank account because bank interest is less than inflation.

Yep, the Chinese have an inbuilt propensity to save money, so banks don’t need to fight for funds so no need to offer high interest rates.

Plus too many rabbits in China!

The propensity to save might be there, but the government policy has been to strongly encourage that saving to be made by way of (now risky) property investments.

It’s the stability of the savings/investment base that is the problem.

It’s worth considering the possibility that non recourse loans may not be as prevalent as previously supposed in the USA.

I had heard it claimed before that only a dozen states actually protected the borrower in this way.

Here’s a quick google hit that looks promising in the hunt for the truth (rather than for a deathmatch in a pit of jelly).

http://realestateresearch.frbatlanta.org/rer/2010/02/did-nonrecourse-mortgages-cause-the-mortgage-crisis.html

China actually has a huge debt issue. While the national numbers generally don’t seem to be alarming, there is real doubts about their reliability – for starters that they exclude the accumulated debt of regional and city governments, which is massive. A lot of this money has been spent on property development – commercial, industrial and infra structure. This extents to things like China’s super-fast train system – or at least the one that was meant to be super-fast…… it isn’t going too well yet.

With an economy likely to go into recession, China has an industrial capacity over-supply problem, being geared for continued growth at a time of likely contraction. Its export customers, especially Europe and the US, have their own (major) economic issues, and resistance to China’s aggressive trading practices (artificially low currency, lack of copyright and patent enforcement, and China’s protectionism) as well as its aggressive mercantilism, means a rocky trading road ahead for a few years. If the customer is broke, he will reduce his buying, dramatically.

China’s has been transitioning to a domestic consumption economy, but that has a long way to go yet.

Which brings us to Australia’s moronic Ambassador – its all okay because the private investors aren’t doing so on credit. Maybe they aren’t – they are just going to lose their life savings…..at a time when the economy is in a downturn, and many are losing their jobs.

One thing that can be certain is that Party Members won’t be losing their life savings – they’ll get it back somehow. And the money will come from those already on the losing side. That single issue is likely to be the cause of political instability in China – losing everything is one thing, but seeing the ruling class then rob their way back to recovery will likely to be too much.

It will be interesting to see how China pans out over the next year – hopefully I’m just being pessimistic!

Here on the flip side is a good summary of how they market is meant to work:

(and if you aren’t familiar with Solyndria, you should look it up – a great example of government intervention in the market that achieving nothing other than squandering about $600 million of taxpayers money, and it wasn’t hard to see the failure coming from the start!)

Twinkies, Kodak, Bailouts, and the Free Market

http://blog.heritage.org/2012/01/10/twinkies-kodak-bailouts-and-the-free-market/

I’m not aware of anyone who thought that the motor industry bailout was a good idea – not Schiff, Keen or Les Richardson 😉 Was that a Keynesian response to stimulate the economy or just corrupt favouritism that the Occupy 99% are chaotically railing against?

I don’t bother with the pigeon-holing of Capitalist or Socialist for individuals. There are good and bad parts and a happy medium somewhere between them.

Socialists are ad hominen creatures by nature. They bash capitalism with fancy slogans, marches and the champagne socialist press using subtle panache: the Sydney Morning Herald promotes Gillard to the Middle Classes without you even realising, the Telegraph rams anti-Gillard down your throat. Socialist journalists, and they predominate the field, are just plain better spin doctors.

Capitalism = greed and selfishness

Socialism = progressive, happy people

Really, should we believe that ?

Yes, I’m happy to live in a social, welfare state, but the State has gone too far and the taxation (directly and hugely indirectly) needs tempering, I believe. Too many handouts, citizens are treated as idiots and self-responsibility is removed and thus self-respect and empowerment; qualities that promote wealth creation and well-being.

“Crony, Capitalist Society”

Nice one, Mike from Heritage.org, that phrase sums it up.

“Occupy,” who I do sympathise with to some extent, want to destroy Capitalism. So, does the entrepreneur who earned $50million via capitalism, known as Michael Moore.

“Greed is Good” folks, it maximises the judicious use of risk-return analysis on investment.

The Twinkies post succinctly reaffirms the definition of Capitalism. The anti-globalist, Left movement don’t like true, meritocratic Capitalism, they much prefer Crony Capitalism – well, if they’re the beneficiaries of the handouts.