Synopsis

A world-first, biological, carbon capture plant is potentially on the horizon to clean up coal power station effluent. This technology, if successful, could be a game changer for energy production: “clean” coal power coupled with renewable petrol production. How close are we to fulfilling that dream?

Algae.Tec will provide the algae-based bioreactors; Bayswater Power Station will provide the Carbon Dioxide food to drive the reaction. It’s a win-win, Algae.Tec primarily finance the project by creating renewable diesel or jet fuel, Bayswater benefit from reduced Carbon Tax liabilities.

Bayswater power station will see some of its carbon dioxide emissions captured on site and fed into sealed tanks packed with algae.

The algae – essentially a form of vegetable oil – will then be harvested and processed at a nearby facility into fuel for sale.

Opinion

President Obama

President Obama claims algal bio-sequestration could potentially be one of the most productive ways to address our fuel needs as the price of gas continues to rise.

Jerry Ellis (Chairman of MBD Energy and former Chairman of BHP)

Jerry Ellis claims algal bio-sequestration is uneconomic, but could be useful in treating agricultural, domestic and industrial waste water. It is still an unproven technology; a work-in-progress.

Summary

In summary, if the chairman of the main competitor to Algae. Tec and former Chairman of BHP, Jerry Ellis, doesn’t currently back this horse, it is probably a filly to look out for in the future, but be perhaps stabled in the present.

Detailed analysis…

The NSW government – Algae Tec. agreement

Bayswater Power Station

On Jul 2nd ‘13, it was announced that the development of an algal, biofuel farm at Macquarie Generation power station had been agreed by all concerned parties. The plan has earned the backing of the federal and state governments, and Macquarie Generation, the NSW state-owned power generator that operates Bayswater. The news of this AUD$140 million development has created some significant hype about the prospects of this burgeoning technology. Should we be taking more than just an onlooker’s interest in this “sustainable”, biofuel source and waste management technology?

The deal involves Macquarie Generation providing land for the biofuels plant, an endless supply of water, CO2 and electricity, and the possibility of carbon abatement credits… Algae.Tec will on-sell the processed fuel.

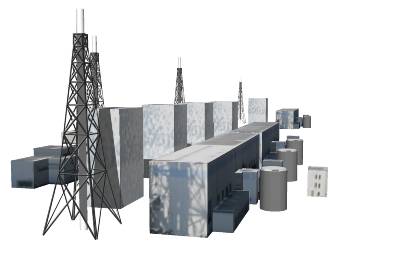

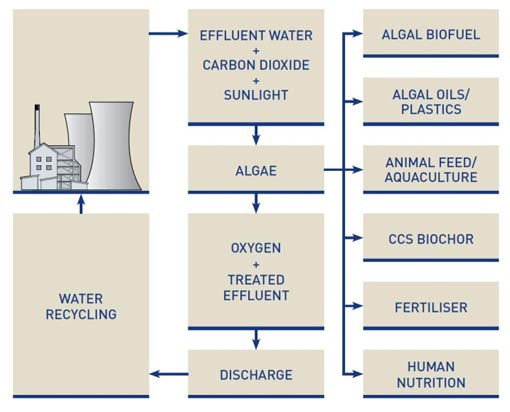

The first phase of the project between Algae.Tec and Mac Gen will be a 400-module facility, which is a large scale up from Algae.Tec’s one-module, proof-of-concept facility in Nowra. The current, project cost for Phase 1 is estimated at A$140 million and construction is slated to begin next year. Each module is a bioreactor tank, about the size of shipping containers, which are designed to grow non-GMO algae on an industrial scale for biofuel production to replace fossil fuels. A major goal of the algal farming industry is to successfully achieve algal bioremediation of industrial emissions, for environmental gain and the sustainable production of valuable products. Bioremediation is the use of micro-organisms, in this case, algae, to metabolise and thus neutralise pollutants. Of particular interest to Algae.Tec and Mac Gen are the removal of pollutants from the effluent water and the reduction of gas, flue emissions, specifically CO2 sequestration.

Bayswater now pumps out about 19 million tonnes of carbon dioxide gas a year; the project (Phase 1) will purportedly capture about 270,000 tonnes of that CO2. Bayswater’s owner Macquarie Generation said that a successful algae fuel plant would help to reduce a carbon tax bill expected to top $500million this year (270M, CO2 tonnes x $24.15 Carbon price = $6MM tax abatement).

The project is particularly valuable to Mac Gen as it reduces their Carbon Tax liability and cleans up their ash dam, effluent water. But, it is also valuable to their partner, Algae.Tec, as the resulting algal oil, a form of vegetable oil, will be converted to biodiesel and hydrogenated to grade A jet fuel at a new biofuels production facility, while waste, vegetable, biomass matter will be converted into pellets for cattle feed.

The Hype

- Algae.Tec says: “In what is said by Algae.Tec to be a world first, carbon dioxide emissions from the power station will be pumped into the facility where the algae will feed on it and convert it into algal oil.”

- Russell Skelton, Macquarie Generation CEO, says: “[Algae.Tec] new technology is improving a traditional power plant. Carbon is now our single largest cost. This technology should reduce our carbon output, reduce our carbon bill, and at the same time improve our bottom line.”

- Partly right: this assumes a $24.15 a metric tonne carbon price still exists, which no longer is the case and is unlikely to return since both Political parties are against the Carbon Tax.

- Roger Stroud, Algae.Tec executive chairman, says:

- “At a time when all the petroleum refining capacity is closing down in NSW, this is the beginning of an era of renewable fuel which can be ‘grown’ in the state and can substitute imported petroleum products.”

- “The Algae.Tec project will make a “small but measurable difference” to Bayswater’s greenhouse gas emissions” (“small” = 1.4% (270M / 19 MM tonnes) of CO2 emissions at a cost of $140MM)

- “The Algae.Tec solution requires less than one-tenth the land footprint of pond growth options, while its enclosed module system is designed to deliver the highest yield of algae per hectare, and solves the problem of food-producing land being turned over for biofuel production”

- “this deal reflects a genuine desire on the part of the NSW Government and the NSW power industry, to support solutions to mitigate carbon dioxide emissions from fossil fuelled power stations”

- Chris Hartcher, NSW Energy Minister, says: “This deal is an innovative means of capturing and reusing carbon emissions and providing the Hunter region with a locally produced green fuel source,”

- A win for NSW government: “The deal is a win for the state government on several fronts. Carbon is now MacGen’s single largest cost, and its capture will reduce the group’s carbon bill and improve its bottom line. Petroleum refining capacity is declining in NSW following Caltex’s decision to shift towards fuel imports, and the biofuel produced at Bayswater can feed immediately into fuel demand from the industry-heavy Hunter region. The region has also seen the loss of many jobs over past years, and the Algae.Tec plant will create around 60 new jobs initially, rising into the hundreds as expansion plans are implemented. Finally, the NSW government has an opportunity to revive its “green” credentials.”

The Algae.Tec, algal, photosynthetic process

The heart of the algal, bioremediative process is the most important biochemical process in nature, photosynthesis. Photosynthesis produces sugar: nature’s primary source of energy. It converts the sun’s power in the form of light into a physical state that can be used as a source of energy for growth and repair. It just happens it requires carbon dioxide (CO2) and water, and has oxygen as a by-product. The Algae.Tec, algal, photosynthetic process is specifically interested in the CO2 requirement as this is a means of fixing carbon and thus preventing its emission as a gas into the atmosphere and thus minimises anthropogenic, CO2-based, Global Warming. The Sugar is also useful to Algae.Tec as it can be harvested for economic gain to help fund the project. In algae, as opposed to land-based crops, this simple sugar is often converted and stored as complex, high energy, lipid oils. After tricky, algae “harvesting” (separation from water) these lipids can then be converted to Biodiesel + Jet Fuel + Ethanol (at a very reasonable, but controversial, $44/barrel according to Algae.Tec) and the left-over biomass can be used as animal feed. The latter conversion involves “extraction” (extracting oil and other components from the algal biomass) and “refining” the ultimate products from those precursors (such as the transesterification of oils to produce biodiesel).

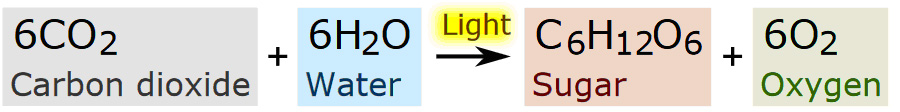

Photosynthesis:

Where

- Light = very intense sunlight (can be problematic in intensive, algal farming)

- C6H12O6 represents carbohydrates such as sugars, cellulose, and lignin, but in algae are often converted to lipid oils.

- NB many other nutrients are found in coal, water effluent (eg macronutrients: nitrate, phosphate; micronutrients: trace metals) that are also needed for algal growth.

Project Financing

Algae.Tec will supply the algae production modules at an expected cost for the initial 400 of $140m. The company expects to recoup costs within 3-4 years. The plan thereafter is to increase the size of the facility to 2000 modules, with a goal of reaching 20,000 modules by 2020. For initial funding, the company is currently anticipating a US bond issue and does not expect to require further equity raising at this stage. Assisting the funding requirement is a 45 cents in the dollar tax rebate from the federal government on profits from biofuel production. The then NSW Energy Minister, Chris Hartcher, announced the deal, and the company is also hopeful of additional state government funding support. Newspaper sources claim that Algae.Tec still needs to raise some funds to get the project underway. The details of who’s actually paying what is not completely clear.

Algae.Tec has engaged energy services specialist Worley Parsons as contractor for construction of the facility. Funding is expected to be secured within six to nine months at which point the requisite pre-feasibility study will be completed and permits secured. Construction is expected to be completed by the June quarter 2014 with first biofuel production anticipated by end-2014.

Algae.Tec Share price

Algae.Tec started in 2007 and is listed on the Australian stock exchange.

Its shares have fallen from 30¢ at the start of the year to 17¢ last week, before rebounding to more than 22¢ this week.

Algae.Tec listed in 2011 on a 20cps offer price and peaked at over 60c in early 2012 on positive news flow. As is the fate of many innovative start-ups, early price jumps provided attractive exit levels for seed investors and initial newsflow gave way to quiet periods as new deals, such as Bayswater, underwent negotiations, leading to waning investor interest. The shares have since drifted back to 20c (a week after the Bayswater announcement) and by Feb’14 they have slipped to 15c.

Competitors

Algal bioremediation is not a new concept and many other companies are also trying to push the lab concept into a viable, industrial-scaled development:

- MBD Energy

- MBD Energy are ahead in the algal, space race as they, since Jan 2013, actually have a “currently functioning”, pilot project downstream of a coal power plant, “Tarong Algal Synthesiser Display Plant Project”. This is a collaboration with the plant’s owners, Stanwell Corp. It also uses coal waste in the form of ash dam water and flue gas to grow algae that is then harvested, i.e. separated from the water, using OriginOil’s “Electro Water Separation” technique. Algae are very small and thus light. Gravity has little effect on them, centrifuges are largely ineffectual and a great deal of electricity is required to remove organics from their aqueous, growing environment. The Tarong facility also aims to clean the ash dam water of its contaminants and self-fund through biofuel and animal feed production.

- “From 2014, one or more of these Algal Synthesisers [only Tarong one was built, planned Eraring and Loy Yang pilot plants never happened] may then be progressively expanded to some thousands of hectares”. MBD has considerable investment backing. But, as of today, they have not gone to Phase 2 of their pilot project, in which they intended to expand their Display Project to a fully-fledged commercial facility at Tarong Power.

- MBD claim they can bioremediate (i.e. remove pollutants) up to 50% of all CO2 emissions a coal power station. This is limited to the fact that coal stations fire 24/7 whilst algae only grow during daylight.

- MBD have had quite a lot of press (National Press Club, ABC News, Channel 7 News, Boardroom TV) and have their lead researcher, Dr Kirsten Heimann, at James Cook University, Townsville. Lead investors include Anglo-American Coal and Sentient. They are looking for Clean Energy Fund funding and have already received from the Australian government’s CRC a grant of $5.4MM. They have spent a total of $30MM thus far in R&D. They claim they, not Algae.Tec, are the first in Australia, but not world, to use algae bioremediation in combination with power plant effluent.

- They claim 1MM tonnes of CO2 can produce $250MM of animal feed and biodiesel.

- Pacific Reef Fisheries, Australia

- Partnered with MBD, have a sea lettuce farm running off prawn farm effluent

- SunEco Energy, USA

- Fish farm based, test, open system, biodiesel reactor in Arkansas since 2011

- Valcent Products, Canada

- Closed system, test reactor in Vancouver

- San Diego Center for Algae Biotechnology, USA

- University scale, test reactor in Imperial Valley, California

- Green Star Products, USA

- In 2009, Planning a 90 reactor project with De Beers in S. Africa (not made still in 2013)

- GreenFuel Technologies, USA

- In 2009, the Harvard-MIT algae company winds down after spending millions and experiencing delays, technical difficulties.

- GreenFuel Technologies, one of the earliest, best funded and most publicized algae companies, is shutting its doors

- Getting the whole thing to run smoothly, though, was tougher than expected. GreenFuel could grow algae. The problem was controlling it. In 2007, a project to grow algae in an Arizona greenhouse went awry when the algae grew faster than they could be harvested and died off. The company also found its system would cost more than twice its target.

- Power Station smokestack model

- Had a test bioreactor at Redhawk Coal Power Station in California in 2007

- Sapphire Energy, USA

- Non-power station, open system

- From 2012, $50 million grant from the Department of Energy and a $54.4 million dollar loan guarantee from the Department of Agriculture, providing security for a privately funded loan

- “The world’s first commercial demonstration scale algae-to-energy farm, integrating the entire value chain of algae-based crude oil production, from cultivation, to production, to extraction of ready-to-refine Green Crude”

Opinions

- Jerry Ellis (Chairman of MBD Energy and former Chairman of BHP):

- Uneconomic (NPV negative), but could be used to treat agricultural, domestic and industrial waste water.

- Unproven technology, a work-in-progress.

- Dr. Heimann (lead researcher for MBD Energy and at James Cook University):

- System optimisation (esp. Harvesting) are limiting factors

- Variety choice is crucial. Algae must grow fast, have high lipid yield and be predator resistant

- Stephen Mayfield (PhD Chairman, Sapphire Energy and Director of San Diego Centre for Algae Biotechnology):

- Currently, too expensive as a biofuel. Needs to be 5x cheaper (at least) to compete with crude oil.

- However, could be made economically viable, not purely as a biofuel, but co-harvesting for nutraceuticals (omega 3 fatty acids, antioxidants) and protein-based pharmaceuticals (normally made very expensively in bacteria)

- Rex Tillerson (Chief Executive of Exxon Mobil):

- An array of proposals is being developed around the globe (see “Competitors” below). But few if any projects appear to have been commercially successful despite substantial research and development spending.

- In March’13, Exxon Mobil chief executive said it might take 25 years to make algae biofuels commercially successful.

- Weeks later, Exxon said it was going back to the “basic science” of algae after spending $100 million in four years without success.

- Tim Liebert (lead process engineer at world’s largest biodiesel plant in Kuantan, Malaysia)

- Biodiesel would have to sell for over $800 per barrel for a coal plant bioreactor to be economic

- Calling it unproven technology understates its problems

- There is no reasonable scenario that would cause either the capital cost or the efficiency of CO2 mitigation to significantly improve

- The strong interest in CO2 to algae results from it alleged photosynthesis conversion efficiency of as much as 12%. This is 120 x the average of all biomass; hence, the stampede of interest, research capital and press coverage. However, the only long term study conducted by NREL of algae farms resulted in an average efficiency of about 1.3%.

- Global Carbon Capture and Storage Institute (which actively includes MBD Energy):

- Bioreactors are used for the production of high-value products such as pharmaceuticals and enzymes (values >$100,000 per tonne). They are currently too expensive for the production of algal nutraceuticals such as astaxanthin(>$10,000 per tonne) and almost all experienced expert advice suggests that photo-bioreactors will not be cost-effective for the production of low-value biofuels (>$1000 per tonne) in the foreseeable future (as of Aug’12).

- Mackinnon Lawrence (Of Counsel at Cleantech Law Partners):

- The primary obstacle is Cost Parity with petroleum-based fuels, which can vary considerably across different production processes. Algae holds great promise, but the break-even point is predicted to still be about five to fifteen years away.

- Secondary obstacles include the energy balance related to produce algae fuel and over-hype, which can create unrealistic expectations among investors.

The pros and cons of algae as a biofuel

Pros

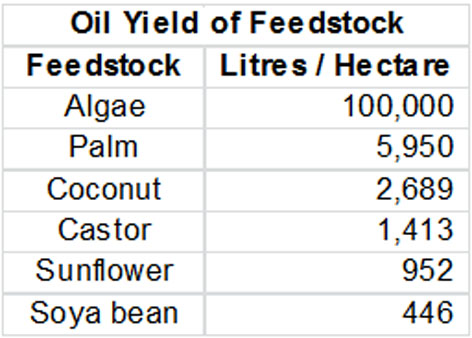

- Compared to terrestrial crops such as corn, soy or even palm plants, algae are far more oil-rich and offer a higher yield of oil per unit of land in a year. The main components of algae are carbohydrates, proteins, and lipids. Of particular interest are the lipids, which can be processed into valuable fuel products such as biodiesel (through transesterification), jet fuel, and even traditional gasoline and diesel depending on the species. Lipids produced from algae contain saturated and polar lipids, which are suitable for use as a fuel feedstock and are contained in higher concentrations than other plants. In some species, 50% of algae weight can be deemed high grade vegetable oil (no land plant can compete with this)

- Doesn’t need to use currently cultivated, good farming land or a clean, non-saline, water supply.

- Synergy with current farms: eg dairy farmers effluent stream can be fed to algae that clean the water and can be harvested for cow feed / biofuel

- Ultra-fast growing (can double weight in 24hrs) and 10x the CO2 sequestering efficiency (rate) compared to land-based plants

- Many varieties with many harvestable products (in particular respect to biofuels, length of carbon chain in lipids)

- Algae fuels are lipid-based and thus are generally considered “fungible” with petroleum (drop-in compatible) and can be used for the production of typical fuels without disruptive changes in processes or infrastructure. Land plants (such as corn / sugar cane) produce hydrocarbon based biomass and thus must be fermented to water-rich ethanol. This leads to engine rust, has a heavy CO2 budget and adds considerable cost to the manufacturing process.

Cons

- Contaminant (eg predators such as the bacteria, protozoa or water fleas) prevention (esp. in open systems) is difficult and can expensively wipe out whole colonies (see GreenFuel Technologies bankruptcy)

- Microalgae are very small. Thus, gravity and centrifuging is largely ineffective in harvesting process. More expensive technologies are required (see OriginOil’s “Electro Water Separation”)

- Farming technologies are complicated, in developmental stage and hard to scale up.

- Biomass waste used for animal feed has limited success as:

- Animal feed, as animals soon refuse it as iodine is too high

- Human food, as algae often feeds on contaminated, industrial/agricultural waste

Summary

In summary, if the chairman of the main competitor to Algae. Tec and former Chairman of BHP, Jerry Ellis, doesn’t currently back this horse, it is probably a filly to look out for in the future, but be perhaps stabled in the present.

Appendix

Who is Algae.Tec?

Algae.Tec Ltd, founded in 2007, is an Australian, advanced, renewable oil from algae, company that has developed a high-yield enclosed algae growth and harvesting system, the “McConchie-Stroud” System. The Company has offices in Atlanta, Georgia and Perth, Western Australia. The Algae.Tec bioreactor, an enclosed modular engineered technology, is designed to grow non-GMO algae on an industrial scale, and produce biofuels that replace predominantly imported fossil fuels. The Algae.Tec solution is less than one tenth the land footprint of pond growth options, while its enclosed module system is designed to deliver the highest yield of algae per hectare, and solves the problem of food-producing land being turned over for biofuel production.

They currently have a one-module, test facility in Nowra, NSW and proposed facilities in Holcim, Sri Lanka and possibly in China, Germany and USA.

Types of bioreactor: open vs. closed system

There are therefore many different photo-bioreactor designs in the literature. The strengths and weaknesses of each design:

Open system, ponds:

- Large scale possible

- Subject to contamination from predator algae strains

- Subject to evaporative water and CO2 loss to the atmosphere

- Difficult to control temperature (day vs. night, seasonal variations)

- Small biomass concentration (1g/litre)

- Require a large amount of nutrients

Closed system, photo-bioreactors:

- Have no contamination and can cultivate a single algal species

- Allow accurate control of nutrients and temperature

- Allow a higher biomass concentration

- Have larger energy consumption

- Have higher capital costs, potentially doubling the final cost of algae product relative to open pond systems

“Essential Reading”

The Lowdown of the state-of-play in a couple of min. from the horses mouths:

By Jerry Ellis, Chairman of MBD Energy (and former Chairman of BHP) + Dr. Heimann (the lead researcher): 11min – 13min (end)

Very eloquent science roundup: Algae Biofuels and Biotech

By Stephen Mayfield, UC San Diego

How the Technology Works – algae to biofuels

By Algae.Tec, Australia